The Global Financial Crisis: What Caused it, Where it is heading?

Ravi Batra, an Indian-born economist from Southern Methodist University in Dallas, Texas, author of many books of a socio-economic nature such as the best-seller “The Great Depression of 1990“, proposes an analysis of the financial crack of 2008 and the solutions for not having any in the future. Some people talk about Ravi Batra as a Cassandra who always forecasts the worst… but unfortunately, he often gets it right.

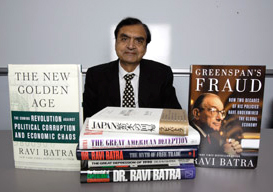

Prof. Ravi Batra and his publications

Two thousand eight was year extraordinaire. It started off in a rather nonchalant way, but ended with a bang. Its myriad and breathtaking events caught the world off guard, but please allow me to say, arrogant as it sounds, that they did not surprise me, including the epoch-making victory of Barack Obama in the US presidential election. I had anticipated them all in two books more than two years ago.

The first, Greenspan’s Fraud, was written in 2005, and the second, The New Golden Age: The Coming Revolution against Political Corruption and Economic Chaos, was finished before October 2006. In fact, the title of the second work itself reveals that I had anticipated an Obama-like revolution in the United States.

It now appears vain to remind the people of my forecasts, but see what I had to endure after I made them. Both books had served to reinforce my reputation as a crack pot, who sought public attention with bogus claims and phony prophecies that occasionally came true. Greenspan’s Fraud was especially galling to my fellow economists, even some of my colleagues. Alan Greenspan was still the chairman of the Federal Reserve in the United States, and had been so for the past 18 years. Some people regard the Fed chairman, with his all-encompassing ability to influence interest rates globally, as the most powerful man in the world.

This is perhaps an exaggeration, but Greenspan, who had actually been in the limelight for over three decades, was more than just a Fed chairman. Investors around the world came to worship him in the 1990s, as share markets broke record after record in many nations. Best-selling author Bob Woodward, who achieved celebrity writing about the Watergate scandal, declared Greenspan as the Maestro in 2000 in a book with the same title. Others were equally euphoric about him. Some called him a rare genius, the best economist ever; even Queen Elizabeth chipped in and knighted him in 2002 as Sir Alan Greenspan. Here I was, a mere professor at Southern Methodist University, who had the temerity not just to criticize him but call his policies self-serving and fraudulent. My book’s title shocked the people, who in turn mocked me without reading my facts and arguments. But sometimes one has to bear insults to bring out the truth.

Where did I learn my economics? The question makes me nostalgic and takes me back into the 1960s, when I was a masters’ student at the Delhi School of Economics. There I studied under luminary professors such as K. N. Raj, Jagdish Bhagwati, Amartya Sen, and India’s current prime minister, Manmohan Singh. They were great teachers and taught me the fundamentals of modern economics.

However, there was one other teacher, whose theories were remarkably different and unknown. He was not even at the Delhi School. I met him in Lucknow, at the time a rather small town in India. He was Shri Prabhat Ranjan Sarkar, a wonderful man of vast knowledge in many different areas. He had written books on history, economics and philosophy among others. Two points stood out in his theories. First, the foundation of prosperity is people’s purchasing power; second, rising inequality eventually destroys any economy.

I left India for the United States in 1966 to do a Ph. D., but Sarkar’s ideas stayed with me and followed me wherever I went. I studied classical economics, Keynesian thought, and numerous other schools, but none focused on what Sarkar had stressed. Finally, I decided to write about his ideas and introduce them to the world, because few paid attention to the gems he had offered. I wrote a number of books based on his theories, starting in 1978, but here I want to emphasize how his ideas enabled me to see through the vacuity and deception of Greenspan’s policies.

The Wage-Productivity Gap

Greenspan focused on company profits and labor productivity as the main engines of economic growth and prosperity. He believed that high profits generate high employment and high wages lead to joblessness. I will now show how this view is myopic and the sole cause of most of the economic travails afflicting the world.

Let me start with a universally acceptable statement. A healthy economy requires that there is a balance between supply and demand. Here supply means the production of goods and services offered to entire society, and demand means society’s demand for such things. Thus, economic balance requires that

Supply = Demand

Without this balance, there is either high unemployment or high inflation. The main source of supply is labor productivity, whereas the main source of demand is the real wage, or people’s purchasing power in Sarkar’s nomenclature. When productivity rises, production or supply goes up and when the real wage increases, consumer spending, and hence investment spending, go up. Because of this investment and new technology, productivity grows over time, which means supply rises over the years. Therefore, demand must also grow proportionately to maintain the economic balance, implying that the real wage must rise in proportion to productivity. However, Greenspan loved to see the rise in productivity but hated the rise in the real wage. He even wanted to abolish the minimum wage, and always argued against its rise, although relentless price increases in the United States had all but demolished its purchasing power. In this respect, the maestro had a lot of company, including the support of President George W. Bush and economic establishment. As a result, the U.S. minimum wage, which peaked at $10 per hour in 1969 in terms of 2008 prices, is now less than $7. Incidentally, the unemployment rate in 1969 was just 3.5 percent, among the lowest in US history.

If the real wage fails to grow as fast as productivity, then over time, a wage-productivity gap develops and

Supply > Demand

Then how do you maintain the indispensable economic balance? This is where the special genius of Greenspan, along with that of conventional economics, came into play. This is where liberal and conservative economists alike, some of them Nobel Laureates, preached their gospel and in the process failed the world.

There is another way through which demand can be raised—new debt. It is an artificial way, and cannot be used forever, but it can postpone the problem for a long time, while the potential economic imbalance builds and cumulates. From 1981 on, U.S. budget deficits, with Greenspan and company advising President Reagan, grew apace. Economists called it fiscal policy, but in reality it was a debt-creating policy. This is how the supply-demand balance was maintained in the presence of the rising wage gap. Thus, for a while, economic balance occurs when

Productivity growth = growth of the real wage plus debt

andThe_Global_Financial_Crisis

new debt = supply – demand

The Profit and Stock-Market Bubbles

Once productivity outpaces the real wage and debt fills the supply-demand gap, company profits skyrocket, because the entire fruit of rising productivity goes to capital income. However, these are debt-supported profits, because without this debt goods will be unsold and profits will fail to materialize. With rocketing profits come rocketing share prices, so everybody becomes happy and begins to dance. This is how Greenspan won the world’s adulation, and no one looked at the magical role played by debt.

Once federal debt began to sore in the United States from 1981 on, it took barely a year, before the Dow Jones Index (the Dow in short) began to rise. The Dow ended the year around 800, but climbed above 2,000 by mid-1987. It had taken the ballyhooed index about 100 hundred years to go past 1,000, but the next 1,000 came in merely two years. A grateful Reagan appointed Greenspan as the Fed chairman in August 1987, but two months later the maestro had to face the music of his own handiwork. The debt-built stock market bubble, founded by that debt-built profit bubble, crashed in the month of October. Greenspan had no idea of how the rising wage gap generates the supply-demand gap. Instead of focusing on wages, he turned to the other way of creating debt. He flooded the world with money and trimmed the interest rate to lure consumers into borrowing. New debt was now created with the help of fiscal policy as well as what economists like to call monetary policy. However, such euphemisms only mask the truth, which is that these policies solve the problem only by generating new debt.

With increasing use of computers and the Internet, productivity began to rise faster than before, while government policies restrained wage growth. So the wage gap continued to rise and actually accelerated. Not surprisingly, new debt played an even larger role during the 1990s. The government did not borrow as much as before, but the public did more than its share. The mushrooming U.S. trade deficit also made a contribution in this regard, because the rest of the world bought American government bonds with its trade surplus that resulted in its dollar hoard. Consequently, American interest rates remained low for a long time and lulled Greenspan and the fawning world into believing that his policies were actually responsible for the surface prosperity.

So the debt-and-stock-market party that had been derailed by the 1987 crash returned with a gusto. This time the world got drunk on the dot.com boom that took share markets to stratosphere, with the Dow crossing 10,000 in 1999. Still no one realized the crucial role played by new debt in the ever growing mania. For a variety of reasons, the US federal government enjoyed a budget surplus in 1999. Since the wage gap continued to rise, I became convinced that the budget surplus would soon generate a supply-demand gap and hence a crash in profits and share prices. That is when I wrote my book, The Crash of the Millennium, predicting that share markets would collapse in 2000 and beyond. This is exactly what happened, because in an environment of the growing wage gap, the moment debt stops growing, supply exceeds demand, over production results, profits tumble and share prices sink. The stock-market crash of 2000-2001 was the worst since the great crash of 1929.

The Housing Bubble

Somehow Greenspan loves bubbles. As the stock market plummeted in 2000, he panicked and slashed interest rates to depths that had not been seen since the depression of the 1930s. He knew consumer demand was inadequate but did not attribute it to the stagnant real wage. He would rather have the public spend money through borrowing than through higher salaries. Greenspan also encouraged people to use their home equity to secure loans and asked banks to lower their lending standards. The banks dutifully followed as they and their CEOs began to make bushels of money. Add to this his deregulation spree that freed banks to trade in the stock market, and bubbles started to emerge in home prices and credit markets. Soon the new bubbles bested even the dot.com balloon of the 1990s. Greenspan still had not realized that since debt cannot grow exponentially all bubbles burst in the end, and when they do the consequences are very painful.

I have just given you a capsule of Greenspan’s follies and policies; there is much more that cannot be presented in a brief article. But the main point is that the maestro succeeded in hiding the true consequences of his actions and tailored his advice to the ideology of whoever became the American president. In the process Greenspan contradicted his earlier policies, mainly to secure his reappointment as the Fed chairman by the incoming president. Today people realize that Greenspan is mostly to blame for the global crisis. In fact, the cable television channel CNN recently included him among the top 10 culprits responsible for the spreading fiasco, but the same CNN had once idolized the maestro.

Greenspan retired in January 2006 and was replaced by Ben Bernanke, who is no different from the former chairman. Mr. Bernanke is also unaware of the role played by sufficiently high wages in restoring economic balance. So he has rehashed Greenspan’s policies at even faster place, although it must be added in his defense that the current mess is not entirely of his making.

Where Are We Headed?

In The New Golden Age, I predicted that economic chaos would begin in 2007 with a housing meltdown in the United States, followed by a banking crisis and share price declines in 2008 and 2009. I now foresee that this crisis would last at least till 2010, and possibly longer. This is because conventional economists still do not understand the nasty economic effects of the wage-productivity gap, which has grown enormously all over the world. If the doctor does not diagnose the sickness properly, the patient has to suffer for a long time. That is why I am afraid the global financial debacle will turn into a steep recession and be the worst since the Great Depression, even worse than the painful slump of 1980-1982 that afflicted the whole world. I have offered a number of economic reforms deriving from the theory of the wage gap in my two books explored above, and it is possible to come out of the recession within a year, but alas conventional economists would not let us escape the looming disaster so quickly.

Yet all is not lost. There is an effulgent silver lining lurking behind the pal of dark clouds. Sarkar’s historical cycles that I have repeatedly used in my forecasts also show that eventually the world will see a wonderfully prosperous era enshrined in the new golden age. This, I feel, could happen by the end of the next decade.

*Prepared for St. Stephen’s College, Delhi.

by Ravi Batra

© November 15, 2008

Professor, Department of Economics

Southern Methodist University, Dallas, Texas 75275, USA

Commenti

The Global Financial Crisis: What Caused it, Where it is heading? — Nessun commento

HTML tags allowed in your comment: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>